Drawing on the entirety of the Company Group’s resources to advance changes responding to customers’ evolving needs, we will be a driving force in shaping the future of people’s lives with automobiles

Please allow me to introduce myself. I am Kiomi Kobayashi. Having won approval at the general shareholders’ meeting held in June 2016, I am the new Chief Executive Officer of AUTOBACS SEVEN.

My career with AUTOBACS SEVEN goes back to 1978, the fourth year after it opened the very first AUTOBACS store – Japan’s first one-stop automotive goods specialty store - in Osaka. That was still early in the development of the company organization and franchise network. Since then, we have established and expanded upon a solid foundation for our business, extending our reach throughout Japan and abroad as well. Under the leadership of my predecessor, Setsuo Wakuda, we also moved forward with store reforms. The Company Group has evolved and grown significantly over these years, providing me with opportunities to build a career on a broad base of experience.

I have learned a great deal as a participant in the development of the AUTOBACS brand. My mission as Chief Executive Officer is to make AUTOBACS a driving force in shaping the future of people’s lives with their cars by responding to changes in the value customers perceive in automobiles. I will do that by drawing on my experience and applying to the fullest extent possible the unique strengths underpinning our brand.

Adapting to a dynamic business environment requires more than anything else decisiveness that is unrestrained by past success and false barriers. I aim to bring a fresh perspective and bold ideas to the advancement of reforms for the Company Group. Toward that end, I will greatly appreciate the ongoing support of shareholders and other AUTOBACS SEVEN investors.

- PROFILE

- Joined AUTOBACS SEVEN in 1978. Named Officer and General Manager for the Kansai Region in 2008, and Director and Executive Officer in 2010. Later named Director and Senior Executive Officer, and Director and Vice Chief Executive Officer. Has also served as Head of Sales Operations and Area Strategy & Planning, and Head of Chain Store Planning and Store Subsidiary Strategy. Having played a leading role in revamping AUTOBACS businesses in Japan, Kiomi Kobayashi was named Representative Director and Chief Executive Officer in June 2016.

How would you assess performance for the fiscal year ended March 2016?

How would you assess performance for the fiscal year ended March 2016?

Despite that externalities caused a decline in sales, operating income rose thanks to factors such as an improvement in the gross margin.

The Company Group finished the fiscal year ending March 31, 2016 with net sales of ¥208.1 billion, down 0.6% year on year, operating income of ¥6.7 billion, up 4.6%, and profit attributable to owners of parent of ¥4.3 billion, down 5.2%.

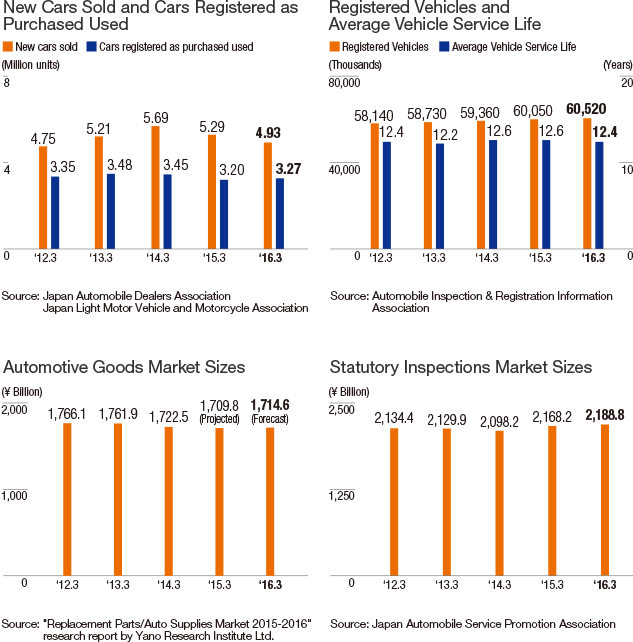

Sales fell primarily because of a 6.8% year-on-year decline in domestic new-car sales and a record-breaking warm winter that weighed heavily on sales of winter tires and other winter merchandise. These factors combined to cause a 5.6% year-on-year decline in sales of automotive goods at domestic stores. That the warm winter was anticipated makes it especially regrettable that we were unable to respond effectively through measures such as a shift of our sales focus to other products. Going forward, this experience will serve as a turning point for designing and implementing retail spaces that are highly responsive to variations in seasonal weather conditions.

On a positive note, steady growth was seen in our statutory safety inspections and maintenance service, where focused in-store approaches by sales staff, and an enhanced online and telephone reservation system, produced a 2.7% increase in vehicles handled, and in our automobile purchase and sales business, where strengthened appraisal capabilities resulted in a 13.4% rise in the total number of vehicles sold.

Turning to earnings, a rise in the gross margin on automotive products, together with other factors, resulted in a 0.4-point rise in the overall gross margin, and gross profit approximating that of the previous fiscal year. SG&A expenses fell by ¥200 million, or 0.4% year on year, as a switch to straight-line depreciation, from the declining balance method, and factors such as a change in advertising and promotion approaches outweighed increases in expenses related to improvements in the store operation system and distribution centers. As for the key issue of improving earnings at domestic store subsidiaries, progress achieved in areas such as improving retail price management and optimizing inventory levels cut the operating loss in half. Steps such as these resulted in higher overall operating income. Nevertheless, with an extraordinary loss of ¥580 million, due to factors such as an impairment loss related to domestic store subsidiaries, profit attributable to owners of parent declined relative to the year earlier.

Consolidated Results for the Fiscal Year Ended March 31, 2016

(¥ Billion)

| Fiscal 2016 | YoY Chg. | |

|---|---|---|

| Net sales | 208.1 | (0.6%) |

| Operating income | 6.7 | 4.6% |

| Profit attributable to owners of parent | 4.3 | (5.2%) |

| ROE(%) | 3.2 | (0.1pt) |

Net Sales of Domestic AUTOBACS Chain Stores (All operations)*

(¥ Billion)

| Fiscal 2016 | YoY Chg. | |

|---|---|---|

| Automotive goods | 214.2 | (5.6%) |

| Statutory safety inspection and maintenance | 17.3 | +4.5% |

| Automobile purchase and sales | 26.6 | +16.0% |

| Other | 4.2 | (7.9%) |

| Total for all stores | 262.4 | (1.5%) |

*Includes net sales attributable to franchise stores.

At the halfway point of the four-year medium-term business plan, how would you assess results?

At the halfway point of the four-year medium-term business plan, how would you assess results?

Success has been achieved in strengthening customer contact points in the domestic AUTOBACS business and in establishing foundations for our “new business” and “overseas business.”

The basic direction set forth under the 2014 Medium-Term Business Plan, which we began implementing in the fiscal year ended March 2015, calls for enhancing the profitability of our core domestic AUTOBACS business and nurturing new business and overseas business as pillars of future growth.

In the domestic AUTOBACS business, we moved forward with efforts to create ongoing relationships with customers to promote the transition to a “one-stop car goods and service” business format. These measures focused on statutory safety inspections and maintenance succeeded in increasing the number of “Maintenance Members” by around 400,000 from the start of the fiscal year, to 2.4 million, while boosting both the numbers of vehicle inspections performed and customers making reservations for this service.

In the automobile purchase and sales business, the third of our core businesses following automotive goods and statutory safety inspections and maintenance, growth in the number of franchise stores further strengthened our nationwide service network. This, together with the opening of stores specializing in used car purchasing, implementation of our patented rapid appraisal system, staff development, and other steps added up to solid progress in laying the groundwork for future growth.

As described above, much was achieved. Much, however, remains to be done. Two areas in particular - understanding the customer’s perspective and enhancing the value we provide - require additional attention.

Regarding Maintenance Members, for example, though we have seen growth in the overall total, the number of members who do not renew the one-year membership is too large. Obvious steps to address this include enhancing member benefits and clearly communicating their value. Also necessary are additional measures to ensure that customers perceive that value every time they use member services. In statutory safety inspections and maintenance, for instance, appreciation for the importance of swift action to enhance efficiency has not yet taken hold adequately in all of our stores. We believe it is necessary, therefore, for our franchise headquarters to take the lead in boosting front-line awareness that rapid turnaround leads to greater customer satisfaction. Regarding new businesses, the BMW and MINI dealerships we took on via M&A in April 2015 have both reported growth in revenue. Profitability has been achieved and we are adding to our knowledge of the business of selling new cars.

In our overseas business, profitability was improved in existing operations in France, Thailand, and other locations, and we are actively moving ahead with business development mainly in the ASEAN countries where motorization is rapidly taking hold.

As described above, a certain degree of progress has been achieved in all of our businesses. Nevertheless, given existing market conditions and our performance, we believe it is not realistic to expect achievement of the targets set forth in the 2014 Medium-Term Business Plan and have decided to revise our medium-term management targets, strategies, and initiatives. The revised plan will be announced by around autumn of the fiscal year ending March 2017.

Progress in Achieving the 2014 Medium-Term Business Plan

| Fiscal 2014 (Previous plan end) |

Fiscal 2015 (Results) |

Fiscal 2016 (Results) |

Fiscal 2017 (Review) |

Fiscal 2018 (Targets) |

|

|---|---|---|---|---|---|

| Management Indicators | |||||

| Operating income (¥ Billion) |

13.9 | 6.4 | 6.7 | 8.0 | 15.0 |

| ROE (%) | 6.8 | 3.3 | 3.2 | 4.4 | 8.0 |

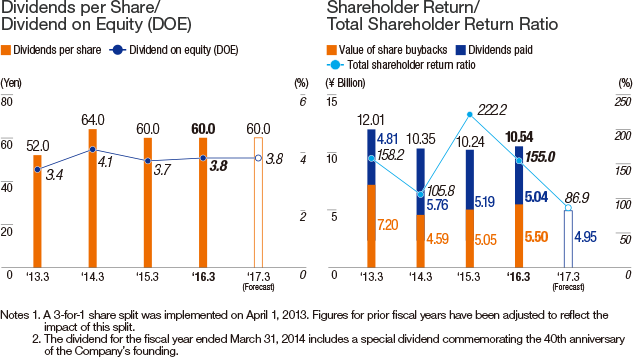

| DOE (%) | 4.1 | 3.7 | 3.8 | 3.8 | 3.0 or higher |

| Key Performance Targets | |||||

| Statutory safety inspections performed (Thousands) | 580 | 589 | 604 | 640 | 800 |

| Number of automobiles sold (Thousands) |

23.1 | 23.9 | 27.1 | 30.0 | 52.0 |

For the domestic AUTOBACS business, what do you see as growth opportunities and risks going forward?

For the domestic AUTOBACS business, what do you see as growth opportunities and risks going forward?

We see our statutory safety inspections and maintenance, and automobile purchase and sales, businesses as growth opportunities and will pursue business development that makes the most of our strengths in these areas.

Given factors such as the ongoing advancement of new vehicle technology and Japan’s low birthrate and aging population, we believe that contraction of the domestic automotive goods market will continue. We see this as our greatest source of risk.

On the other hand, the number of registered vehicles is up to about 60 million and vehicles are remaining in use for periods beyond 12 years. This means we can look forward to stable demand for statutory safety inspections and maintenance. The Company Group is the market share leader in automotive goods, but has only about 2% of the market for statutory safety inspections, so we see plenty of room for growth. With the advancing use of electronics in automobiles, and the growing popularity of electric vehicles and hybrids, the provision of statutory safety inspection and maintenance services is requiring rapidly rising levels of technical sophistication. We think that adds up to a coming shakeout among small and medium-size service providers and a positive outlook for the Company Group, which has the organizational wherewithal required going forward.

Growth opportunities also exist in the domestic used car market, where annual vehicle registrations have remained in excess of three million. Though a latecomer to this business, the Company Group’s ability to offer automotive goods, together with statutory safety inspections and maintenance services, is a strength found in no other company, and we will use high customer-visit frequency at our stores, and thorough after-sale follow-ups, to expand our market share.

In addition, we see substantial promise in the internet as a new sales channel. For the most recently ended fiscal year, online net sales came to ¥3.0 billion, up more than 80% from the previous fiscal year. Going forward, we will pursue synergies between our online and brick-and-mortar stores to boost sales on all fronts.

The growth model for the domestic AUTOBACS business is to make the most of these opportunities and strengthen sales initiatives, including ones through the online channel, to enhance customer contact points, while also taking advantage of statutory safety inspections as an opportunity to sell automotive goods, and channel customers to our automobile purchase and sales business. Synergistically linking a broad array of goods and services allows us to differentiate ourselves by providing customers with convenience and peace of mind that competitors offering standalone services cannot. That has been our strategic direction to date and should remain so going forward.

How will the domestic AUTOBACS business evolve going forward?

How will the domestic AUTOBACS business evolve going forward?

Keeping our current direction and strategy in place, we will enhance the attractiveness of our stores to keep up with the times and move forward with the reconstruction of our brand.

As I have explained above, there will be no change in our aim to provide a comprehensive range of support for customers’ car-related needs or in our long-term strategy of strengthening our connections with customers by using statutory safety inspections and maintenance as the starting point. Robustly carrying forward along these lines, however, requires that we reinvent AUTOBACS by increasing the attractiveness of our goods and services.

The business model our predecessors developed has come to be widely known, together with the AUTOBACS brand. Nevertheless, with time, the character of the motorized society has changed. The value consumers attach to automobiles has diversified making it necessary to review the ways in which customers and society see the brand image we have created, and reinvent our brand. This means breaking down and applying what can be learned from the customer feedback we have received to date to offer goods, services, and stores that are even more attractive, while also developing a business model envisioning the coming 10 to 20 years.

Critical to that effort will be the awareness and conduct of employees who interact with customers on a daily basis. Having the people who will lead AUTOBACS in the future feel the joy of growing together with the company, as I did when I came on board, will naturally result in their taking on the awareness and adopting the conduct needed for our future. By having management advance change to keep up with the times, and creating an environment that allows all employees, including those at franchise stores, to see the Company change and feel it is worthwhile to work at AUTOBACS, we will build a new AUTOBACS with the participation of everyone on board.

Could you please describe the directions to be taken with the new business and overseas business operations?

Could you please describe the directions to be taken with the new business and overseas business operations?

Efforts will be focused on expanding the imported-car sales businesses we have recently entered and developing business in the ASEAN countries.

At present, our core business - the domestic AUTOBACS business - accounts for nearly 90% of the Company Group’s net sales. Considering that Japan’s declining birthrate and aging population will cause the automotive goods market to contract even further, it is necessary to optimize our business portfolio by developing our new business and overseas business into operations of significance approaching that of our domestic AUTOBACS business.

Regarding our new business operations, we will further strengthen our new-car sales, which are now in the black, to increase their contributions to business results. At the same time, we aim to establish new businesses in areas that open the door to synergies with the domestic AUTOBACS business to ultimately expand the added value provided by the Company Group as a whole.

In our overseas business operations, we will continue with efforts to accelerate growth by implementing initiatives in the ASEAN countries and other growth markets. Toward that end, it is critical that we emphasize adaptation to local societies, and not simply try to do what succeeded in Japan. Every market has its own unique car culture and business practices, so our approach will be to emphasize local business practices by working with partners who understand the particulars of individual markets.

What is envisioned regarding shareholder returns?

What is envisioned regarding shareholder returns?

We aim to pay returns that will satisfy shareholders, while also taking investment strategies and other factors into account.

Shareholder returns is among the top management priorities at AUTOBACS SEVEN. For the fiscal year ended March 2016, we continued with our dividend policy of maintaining a DOE of 3% or higher and, accordingly, declared dividends of ¥60 per share for the full year (DOE 3.8%). Keeping dividends at the same level for the fiscal year ending March 2017, we are planning to again pay a full-year dividend of ¥60 per share (DOE 3.8%).

Over the past several years, we have been purchasing our own shares to enhance both balance sheet efficiency and ROE. To achieve growth under our current medium-term business plan, however, we have decided to focus on investments aimed at renovating stores, developing new business, and accelerating overseas business development. Aiming to balance investment with returns to shareholders, while maintaining liquidity, including working capital, at the current level, we announced no further share buybacks when full-year results were released (as of May 2016).

As for fiscal years ending March 2018 and beyond, we intend to continue expanding our business while also paying shareholders returns they will be satisfied with. Details will be announced together with the next medium-term business plan.

We will greatly appreciate the ongoing support of shareholders and other investors going forward.