Strengthening Governance for Corporate Governance System Sustainable Growth in Corporate Value

A company seeks to achieve increases in corporate value over the medium-to-long term by pursuing aboveboard business activities with capital entrusted to it by shareholders. As an entity recognized in law, it is expected to contribute to society through business activities reflecting consideration of responsibilities to customers, shareholders, employees, suppliers, local communities, and all other stakeholders. Company managers must engage in business activities that effectively contribute to the company’s role in society; their actions must be in the interest of the company’s ongoing development and of accountability, to ultimately promote management transparency and the fulfillment of responsibilities to society.

With these ideas as a conceptual foundation, the Company strives to maintain the support and trust of all of its stakeholders. Starting from our number one priority - underpinning and enhancing the AUTOBACS brand by perpetually offering goods and services that please customers, while also living up to our social responsibilities - we constantly strive to strengthen and improve our corporate governance.

Corporate Governance Key Points (as of June 21, 2016)

Strengthening the Supervisory Function

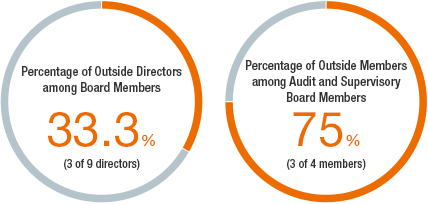

Actively Appointing Outside Directors and Audit and Supervisory Board Members

Having a Board of Directors with more than 30% of its members from outside the Company strengthens the oversight function and secures transparency and objectivity in decision-making.

Securing Transparency and Objectivity in Appointments and Remuneration

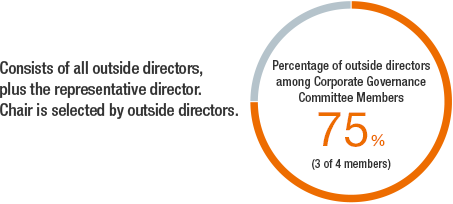

Establishment of the Corporate Governance Committee as a Consultative Body for the Board of Directors

The Corporate Governance Committee promotes management transparency and objectivity by acting as a consultative body to the Board of Directors on matters concerning the appointment and remuneration of directors and senior executive officers.

Separation of Execution and Supervisory Functions

Adoption of an Executive Officer System to Clarify Management Responsibility

To maintain and enhance the supervisory function of directors, an executive officer system has been adopted to separate business execution and supervisory functions.

Protecting Returns to General Shareholders

Selection of Only Qualified Independent Individuals as Outside Directors and Audit and Supervisory Board Members

By selecting only individuals who meet the requirements for “Independent Directors/Auditors,” as that term is used by the Japan Exchange Group, to serve as outside directors and Audit and Supervisory Board members, we are not only ensuring the independence of outside directors and outside Audit and Supervisory Board members but also protecting returns to general shareholders.

Swift and Proper Decision-Making and Consensus Formulation

Proper Sharing and Discussion of Information among Directors and Officers

To enable swift and proper discussion and decision-making by the Board of Directors, the various committees comprised of officers provide the Board of Directors with appropriate information on management issues and business performance.

Recent Changes to Strengthen Corporate Governance

- FY ended

March 2006 -

- Outside directors: 2 out of 10 total directors

- Establishment of the Nomination Advisory Committee (Integrated into the Corporate Governance Committee in April 2010)

- FY ended

March 2009 -

- Outside directors: 4 out of 9 total directors

- Outside Audit and Supervisory Board members: 3 out of 5 total members

- Establishment of the Corporate Governance Committee

- Establishment of the Risk Management Committee

- Establishment of the Executive Committee, and other types of committees, to strengthen the business execution framework

- FY ended

March 2010 -

- Formulation of the Corporate Governance Policy

- FY ended

March 2011 -

- Outside directors: 3 out of 8 total directors

- Revision of the Management Philosophy

- Formulation of the Outside Director and Audit and Supervisory Board Member Requirements

- FY ended

March 2012 -

- Outside Audit and Supervisory Board members: 3 out of 4 total members

- FY ended

March 2016 -

- Establishment of the position of Senior Independent Director

- Establishment of the Independent Executive Liaison Group

- Establishment of the Director Evaluation Committee

View the PDFs below for more information.

- Corporate Governance System (80KB)

- Nomination of Inside Directors and Senior Managers/ Outside Directors and Outside Audit and Supervisory Board Members/ Remuneration for Members of the Board of Directors, Audit and Supervisory Board Members, and Officers (122KB)

- Facilitating the Exercise of Voting Rights/ Dialogue with Investors/ Compliance/ Risk Management (76KB)